Investors are eagerly awaiting the latest US employment data, due in the coming days. It will largely determine whether the Federal Reserve will decide on another rate cut at the end of October.

The employment report could be key for the bond market

But there’s a serious risk: if the federal government goes into shutdown on October 1, the release of the data will have to be delayed. This would be a blow to the market, as these figures help us understand the direction of the economy.

The market is pricing in a nearly 80% rate cut

Traders are currently pricing in an approximately 80% chance of a rate cut at the October 28-29 meeting. But for this confidence to be strengthened, a weak employment report is needed. If the number of new jobs comes in higher than expected, faith in imminent monetary easing will be shaken.

“These are the very data points that can push the market up or down. Without a weak report, the story of an economic slowdown looks incomplete,” investment fund managers explain.

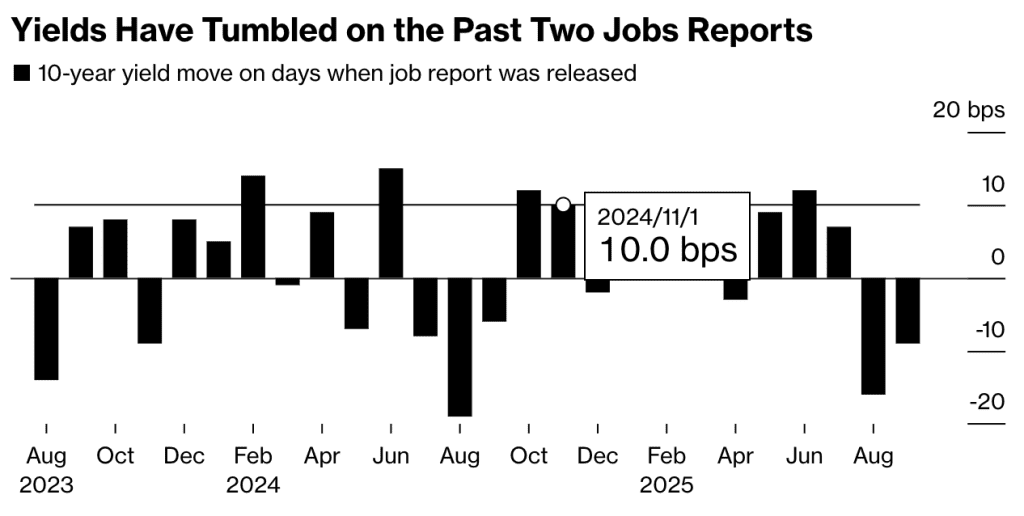

Bond yields fluctuate

Last week, the yield on the 10-year Treasury note rose to 4.2% after falling below 4% on September 17, the year the Fed cut its rate by a quarter point. However, disagreements within the Fed and mixed macroeconomic data are keeping the market tense.

On the one hand, jobless claims remain low, and economic growth in the second quarter was stronger than expected. On the other hand, hiring has weakened significantly in recent months, prompting the Fed to take its first step toward easing.

Disagreements within the Fed

There is disagreement within the Fed. Some board members, including new members, warn of inflation risks and oppose too sharp a rate cut. Others believe that cooling the labor market requires swift action, even though inflation is still above the target level.

Forecasts and Expectations

US economy added about 50,000 jobs in September. This is slightly above the average growth rate of recent months, but not enough to keep the unemployment rate stable.

If this forecast is confirmed, the Fed will have more grounds for another rate cut at the end of October. However, any surprise—from a government shutdown to a strong earnings report—could dramatically change the balance of power in the bond market.

US Job Growth to Remain Modest Ahead of Fed Meeting

In September, job growth in the US is expected to be weak again, with unemployment remaining at 4.3%—the highest level in nearly four years. Economists surveyed by Bloomberg estimate that the economy added approximately 50,000 new jobs. This marks the sixth consecutive month of moderate labor market performance.