The global digital payments landscape has undergone a revolutionary transformation, driven by advances in financial technology and changing consumer expectations for seamless transaction experiences. Modern digital payments infrastructure encompasses instant payment systems, sophisticated payment gateways, and locally-tailored solutions that collectively enable billions of transactions worldwide. Understanding these interconnected components has become essential for businesses, financial institutions, and policymakers navigating the rapidly evolving payments ecosystem.

The Foundation of Digital Payments Infrastructure

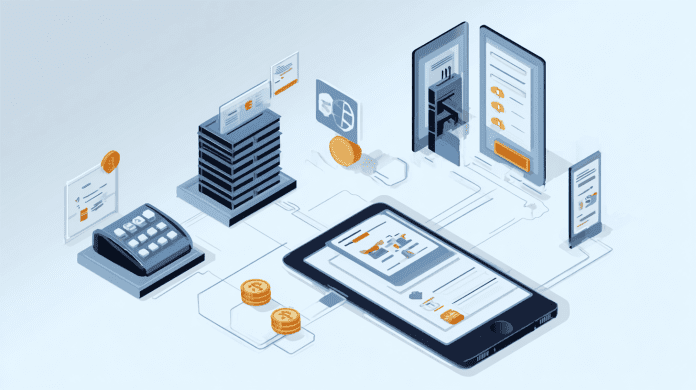

Digital payments infrastructure represents the backbone technology that enables electronic money transfers between parties through various channels and methods. This infrastructure combines hardware, software, networks, and protocols that facilitate secure, efficient, and reliable payment processing across multiple platforms and geographical boundaries.

The modern payments ecosystem relies on several key components working in coordination. Payment processors handle transaction authorization and settlement, while clearing networks facilitate communication between financial institutions. Security protocols ensure transaction integrity and protect sensitive financial data throughout the payment flow.

Central bank digital currencies (CBDCs) and real-time gross settlement systems form the foundational layer of national payments infrastructure. These systems provide the ultimate settlement mechanism for digital transactions while ensuring monetary policy effectiveness and financial system stability.

The interoperability between different payment systems has become increasingly important as consumers and businesses expect seamless experiences across various payment methods, devices, and geographic locations. This requires standardized protocols and robust integration capabilities that enable diverse systems to communicate effectively.

Instant Payment Systems: Speed and Efficiency

Instant payment systems have emerged as a critical component of modern financial infrastructure, enabling real-time money transfers that complete within seconds rather than days. These systems address longstanding limitations of traditional payment methods while meeting growing consumer and business demands for immediate transaction settlement.

Real-time payment networks operate continuously, processing transactions 24 hours a day, seven days a week, including holidays and weekends. This availability contrasts sharply with traditional banking systems that typically process payments only during business hours and may require several days for settlement completion.

The architecture of instant payment systems typically involves direct connections between participating financial institutions through a central switching infrastructure. This design eliminates intermediate settlement delays while maintaining security and regulatory compliance requirements that protect both consumers and financial institutions.

Faster Payments Service (FPS) in the United Kingdom, UPI (Unified Payments Interface) in India, and Zelle in the United States represent successful implementations of instant payment infrastructure that have transformed domestic payment behaviors and expectations.

The economic benefits of instant payments extend beyond convenience to include improved cash flow management for businesses, reduced reliance on credit facilities, and enhanced financial inclusion through accessible digital payment options.

Payment Gateway Architecture and Functionality

Payment gateways serve as the critical interface between merchants and the broader payments infrastructure, enabling businesses to accept digital payments through various channels while managing security, compliance, and operational requirements.

These platforms handle payment authorization by securely transmitting transaction data between merchants, acquiring banks, payment networks, and issuing banks. The gateway encrypts sensitive payment information and applies fraud detection algorithms before routing transactions through appropriate settlement networks.

Modern payment gateways support multiple payment methods including credit cards, debit cards, digital wallets, bank transfers, and alternative payment methods. This flexibility enables merchants to offer diverse payment options while maintaining unified transaction processing and reporting systems.

The integration capabilities of payment gateways have evolved to support omnichannel commerce experiences where consumers can initiate transactions across multiple touchpoints including online stores, mobile applications, point-of-sale terminals, and social media platforms.

Advanced payment gateways incorporate machine learning algorithms for fraud detection, real-time transaction monitoring, and dynamic risk assessment that adapts to changing threat patterns. These capabilities help merchants balance security requirements with customer experience optimization.

Local Payment Solutions and Regional Adaptations

Local payment solutions address specific market characteristics, consumer preferences, and regulatory requirements that vary significantly across different countries and regions. These solutions often become dominant in their respective markets by offering features and capabilities that global payment systems cannot easily replicate.

Mobile money systems in Africa, such as M-Pesa in Kenya, demonstrate how local payment innovation can leapfrog traditional banking infrastructure to provide financial services to previously underserved populations. These systems leverage mobile phone networks to enable payments, savings, and lending services without requiring traditional bank accounts.

QR code-based payment systems have gained widespread adoption in Asia, with platforms like Alipay and WeChat Pay in China, and similar systems across Southeast Asia. These solutions integrate payment functionality with broader digital ecosystems including e-commerce, social media, and lifestyle services.

Open banking initiatives in Europe and other regions enable local fintech companies to develop innovative payment solutions that leverage existing banking infrastructure while providing enhanced user experiences and specialized functionality for specific market segments.

The success of local payment solutions often stems from their ability to integrate with existing business practices, support preferred payment behaviors, and navigate local regulatory requirements more effectively than global alternatives.

Technical Infrastructure and Security Considerations

The technical architecture underlying digital payments infrastructure must balance multiple competing requirements including speed, security, scalability, and reliability. Modern payment systems employ distributed computing architectures that can handle millions of transactions while maintaining strict security and availability standards.

Encryption technologies protect payment data throughout the transaction lifecycle, from initial capture through final settlement. Advanced cryptographic protocols ensure that sensitive information remains secure even if intercepted during transmission or storage.

Tokenization systems replace sensitive payment data with non-sensitive tokens that cannot be used for fraudulent transactions. This approach reduces the security burden on merchants while maintaining payment functionality and enabling features like recurring payments and stored payment methods.

API-first architectures enable payment systems to integrate seamlessly with modern business applications and support innovative payment experiences. These interfaces provide standardized methods for accessing payment functionality while abstracting the complexity of underlying infrastructure.

Cloud-based payment infrastructure offers scalability and reliability advantages while enabling rapid deployment of new payment capabilities. However, cloud adoption must address regulatory requirements for data sovereignty and security that vary across jurisdictions.

Regulatory Compliance and Standards

Digital payments infrastructure operates within complex regulatory frameworks that address consumer protection, financial stability, anti-money laundering, and data privacy concerns. Compliance with these requirements is essential for maintaining operating licenses and consumer trust.

Payment Card Industry Data Security Standard (PCI DSS) requirements mandate specific security controls for any organization that processes, stores, or transmits payment card data. These standards cover technical and operational requirements including network security, access controls, and vulnerability management.

Strong Customer Authentication (SCA) requirements in Europe mandate multi-factor authentication for electronic payments, requiring payment infrastructure to support additional authentication methods while maintaining user experience quality.

Open banking regulations require financial institutions to provide secure APIs that enable third-party access to customer account information and payment initiation services. This regulatory framework is driving innovation while creating new competitive dynamics in the payments market.

Anti-money laundering (AML) and know-your-customer (KYC) requirements necessitate robust identity verification and transaction monitoring capabilities within payment infrastructure. These systems must detect suspicious patterns while minimizing false positives that impact legitimate transactions.

Cross-Border Payments and Global Connectivity

Cross-border payments represent a particularly complex aspect of digital payments infrastructure, involving multiple currencies, regulatory jurisdictions, and correspondent banking relationships. Traditional cross-border payments often suffer from high costs, long settlement times, and limited transparency.

SWIFT gpi (Global Payments Innovation) initiative aims to improve traditional correspondent banking by providing end-to-end payment tracking, faster settlement, and transparent fee structures. While still relying on existing banking relationships, gpi demonstrates how incremental improvements can enhance cross-border payment experiences.

Blockchain-based payment networks offer alternative approaches to cross-border transfers by enabling direct peer-to-peer transactions that bypass traditional correspondent banking infrastructure. These systems can potentially reduce costs and settlement times while increasing transparency.

Central bank digital currencies (CBDCs) may eventually enable more efficient cross-border payments through direct central bank cooperation, eliminating many intermediate steps and associated costs. However, CBDC implementation requires careful consideration of monetary sovereignty and financial stability implications.

Remittance-focused solutions have emerged to serve specific cross-border payment use cases, often leveraging local payment infrastructure in destination countries to provide competitive exchange rates and delivery options tailored to recipient preferences.

Future Trends and Innovations

The evolution of digital payments infrastructure continues to accelerate, driven by technological advances and changing consumer expectations. Artificial intelligence and machine learning are increasingly integrated into payment processing to improve fraud detection, optimize transaction routing, and personalize user experiences.

Internet of Things (IoT) payments enable embedded payment capabilities in connected devices, from smart cars to household appliances. This trend requires payment infrastructure to support machine-to-machine transactions while maintaining security and user control.

Programmable payments using smart contracts and automated execution rules could transform how businesses manage recurring payments, conditional transfers, and complex payment workflows. This capability requires integration between payment infrastructure and blockchain or distributed ledger technologies.

Real-time data analytics and reporting provide merchants and financial institutions with immediate insights into payment patterns, customer behavior, and operational performance. These capabilities enable more responsive business decisions and improved risk management.

The convergence of payments with other financial services including lending, insurance, and investment management is creating comprehensive financial platforms that offer integrated experiences for consumers and businesses.

Digital payments infrastructure will continue evolving to meet growing demands for speed, convenience, and security while supporting new payment use cases and business models. Success in this environment requires continuous innovation and adaptation to changing technological and regulatory landscapes.

The foundation established by current instant payment systems, sophisticated gateways, and local solutions creates the platform for future innovations that will further transform how money moves through the global economy.