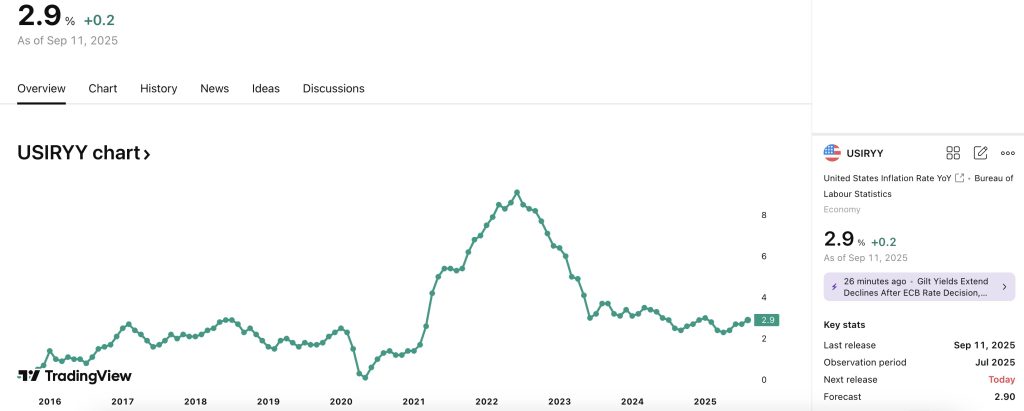

Inflation nudged higher in August, adding another layer of complexity for the Federal Reserve just days before its next policy meeting.

The latest government data showed consumer prices up 2.9% from a year ago, compared with July’s 2.7%. On a monthly basis, prices advanced 0.4%, a faster pace than economists expected. Gasoline costs did much of the lifting, with food prices also running firm.

Excluding food and energy, core inflation held steady at 3.1%. Core prices ticked up 0.3% for a second straight month, marking the sharpest two-month stretch since February.

The numbers arrive as investors debate how aggressive the Fed will be next week. Traders still see a quarter-point cut as the likeliest option, though weaker job data — including jobless claims rising to 263,000, the highest in four years — has opened the door to a bigger move.

“This report probably won’t stop the Fed from trimming rates by 25 basis points,” said Thierry Wizman of Macquarie. “But it may push officials to signal more caution about the path ahead.”

There were some mixed signals inside the report. Medical services edged lower after a big July jump, while recreation and telecom costs eased. Airline fares, on the other hand, jumped nearly 6%, extending a summer surge.

Wholesale prices offered a softer read: the Producer Price Index slipped 0.1%, its first decline in four months, suggesting some companies are eating the added cost of tariffs rather than passing them on.

Taken together, the data shows inflation hasn’t gone away, but it’s no longer broad-based. For the Fed, that means cutting rates to shore up growth while staying alert to the risks that tariffs and stubborn categories could reignite price pressures.