The US Federal Reserve and the world’s major central banks, according to the latest forecasts, intend to continue easing monetary policy until the end of the year, while Europe, by contrast, is temporarily halting its rate-cutting cycle.

The Federal Reserve is preparing for a new round of rate cuts, while Europe is taking a break

According to Bloomberg Economics, of the world’s 23 largest central banks, 15 are preparing to lower borrowing costs, while only a few, including the Bank of Japan, are likely to raise rates. In Europe, more and more countries are opting for a “breathing break,” from Frankfurt to London and the Scandinavian capitals. Even in Switzerland, where the latest rate cut is expected, analysts see it as a short-term measure.

The Federal Reserve is moving according to its own schedule

Following the September interest rate cut, the US Federal Reserve is prepared for two more rate cuts by the end of 2025, followed by a gradual easing of policy over the first three quarters of 2026. This gradual pace is explained by the Fed’s caution amid rising prices caused by President Donald Trump’s tariff policies.

The US federal funds rate is currently at 4.25%, and according to Bloomberg Economics, it could fall to 3.75% by the end of 2025. Markets are already priced in for two consecutive quarter-point cuts.

The upcoming Fed meeting on October 28-29 will be key, as the regulator will balance the risks of rising inflation with the threat of a cooling labor market.

Politically, pressure is mounting—Trump continues to demand the Fed accelerate rate cuts and may soon announce a candidate to replace current Chairman Jerome Powell, whose term expires in May.

“If the Fed cuts rates too quickly, inflation could accelerate; if too slowly, unemployment will begin to rise. The Fed will choose a path of cautious, gradual easing,” Bloomberg Economics analysts note.

Europe Prefers Caution

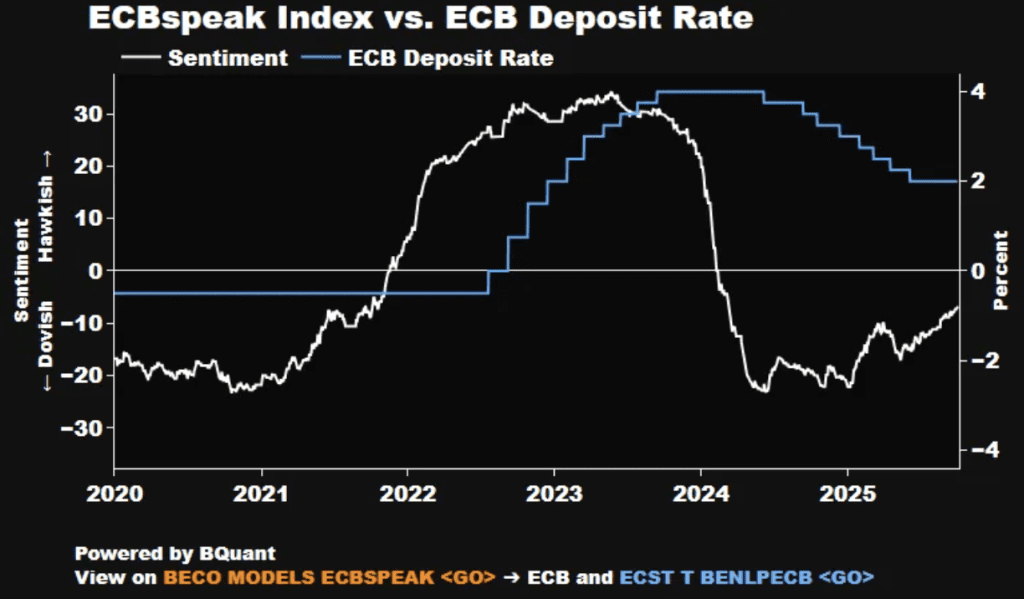

The European Central Bank (ECB), on the other hand, is prepared to pause its rate-cutting cycle, focusing on keeping inflation near its 2% target.

The current deposit rate is 2%, and Bloomberg Economics forecasts it will remain there until the end of next year.

ECB President Christine Lagarde emphasized that the eurozone economy is demonstrating resilience even amid rising US tariffs, and further easing is not currently required.

However, if inflation continues to decline, another step toward cheaper borrowing is possible by the end of 2026.

“The ECB has effectively completed its easing cycle, but retains room for action if economic momentum worsens,” Bloomberg analysts note.

Bank of Japan Prepares to Hike Rates

Unlike its Western counterparts, the Bank of Japan is considering raising its key rate for the first time in many years. The Bank of Japan’s leadership, chaired by Kazuo Ueda, may raise the target rate from 0.5% to 0.75% as early as October.

Inflation in Japan has remained above 3% for more than three years in a row, the yen has partially strengthened, and falling oil prices are creating favorable conditions for policy tightening.

The market is also factoring in the possible appointment of Sanae Takaichi as Prime Minister—she is known as a proponent of a soft monetary policy, making the Bank of Japan’s move particularly significant.

The Bank of England remains on hold

The UK is maintaining a wait-and-see stance.

Analysts predict that the Bank of England’s key interest rate will remain unchanged at 4% until the end of the year.

The market expects several rate cuts as early as 2026, when inflation finally stabilizes.

“The Bank of England is focused on keeping inflation under control and is in no rush to take steps that could trigger renewed volatility in the pound,” notes Bloomberg Economics.

The Big Picture: Cautious Easing and High Uncertainty

According to Bloomberg Economics’ consolidated estimates, aggregate interest rates across the world’s largest economies will remain higher by the end of 2025 than projected in the summer. This reflects a combination of moderate growth and lingering risks to price stability.

Political pressure, trade disputes, and uncertainty in the US and Asia are complicating central banks’ tasks.

If Trump continues to escalate protectionist policies, the Fed may be forced to move faster, while Europe and Asia will struggle to balance inflation and growth.

In a strategic move following the passage of the GENIUS Act, representatives of the US Federal Reserve devoted a significant portion of their latest meeting to analyzing the impact of stablecoins on the country’s financial system.