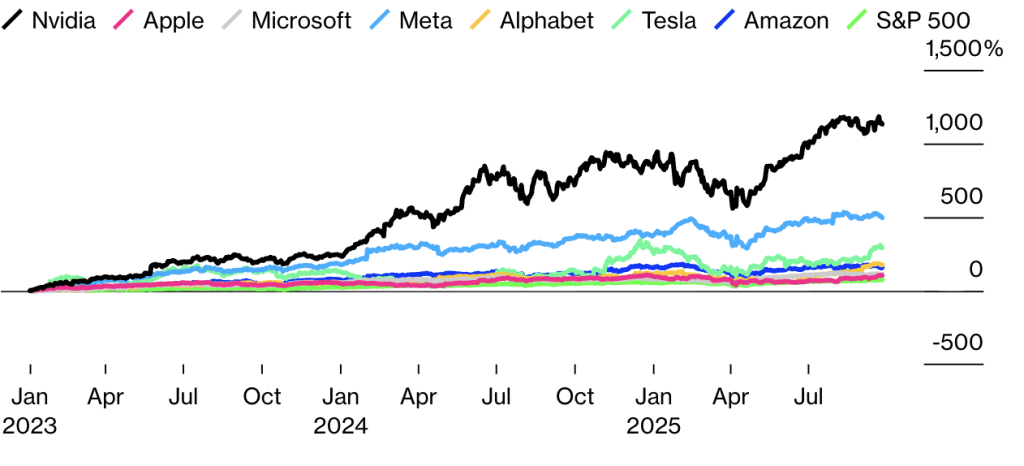

The “Magnificent Seven,” which includes giants like Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta, and Tesla, is increasingly out of touch with the reality of the rapidly evolving artificial intelligence market. Although these companies have accounted for more than half of the S&P 500’s growth since the beginning of 2023, voices are growing that the true AI leaders may be entirely different players.

Why the “Magnificent Seven” is Losing Relevance

Initially, this group was considered a symbol of the technological breakthroughs of recent years—from the internet to smartphones and e-commerce. But today, the field of AI has expanded far beyond the narrow circle of the largest corporations.

Investors and analysts note that the potential of companies like Broadcom, Oracle, and Palantir is far more significant for the future of artificial intelligence. Their successes are already noticeable—for example, Palantir’s shares rose more than 130% in 2025, and Oracle achieved record growth thanks to its cloud services.

New Leadership Candidates

Wall Street is actively proposing alternatives to the familiar “G7.” Versions of the “Magnificent Four” (Nvidia, Microsoft, Meta, and Amazon), the “Big Six” without Tesla, and even the “Elite Eight” with the addition of Broadcom have emerged. But even these lineups are insufficient to cover the entire AI market. Taiwan Semiconductor, Arista Networks, Micron, and data storage companies are also becoming important players, without which it is impossible to imagine the infrastructure of the new technological order.

Prospects and Risks

Apple and Tesla appear more vulnerable: Apple is not yet able to offer significant AI breakthroughs, while Tesla is suffering from declining electric vehicle sales and competitive pressure. However, both companies remain attractive to investors thanks to their long-term ambitions in AI—whether it’s the iPhone as the key to AI services or Musk’s projects in autonomous vehicles and robotics.

Market history shows that “fashionable” stocks sooner or later give way to new favorites. The Nifty-Fifty in the 1960s, the FAANG in the smartphone era—all of them once seemed undisputed leaders. Now it’s the turn of the Magnificent Seven. And the question is whether there will be a smooth rotation in favor of new names or whether we’ll face a sharp reversal.

Starbucks is without a CTO: an acting CTO has been appointed

Starbucks has undergone a leadership shakeup: CTO Deb Hall Lefevre is leaving the company. Ningyu Chen, Senior Vice President of Global Engagement Technologies, has been appointed in her place on an interim basis.

Lefevre joined Starbucks in 2022 after working at McDonald’s and has now decided to retire. A permanent successor has not yet been determined.

The departure coincides with a significant milestone for the company: Starbucks is actively implementing AI tools and simultaneously streamlining its workforce, cutting hundreds of corporate positions.