XRP is currently trading at $2.97, up 2.07% in 24 hours, according to analytical service TradingView. After several months of sideways movement, traders are awaiting confirmation of a breakout. A sideways trend, or “flat,” forms when the market is uncertain and the asset price fluctuates within a narrow range. During such periods, bulls and bears seem to call a temporary truce, waiting for a new impetus.

XRP Technical Analysis: Signal for Growth Strengthens

Meanwhile, other tokens with growth potential are also attracting investor attention, such as Maxi Doge ($MAXI), a project already being touted as a top candidate for the month’s surge.

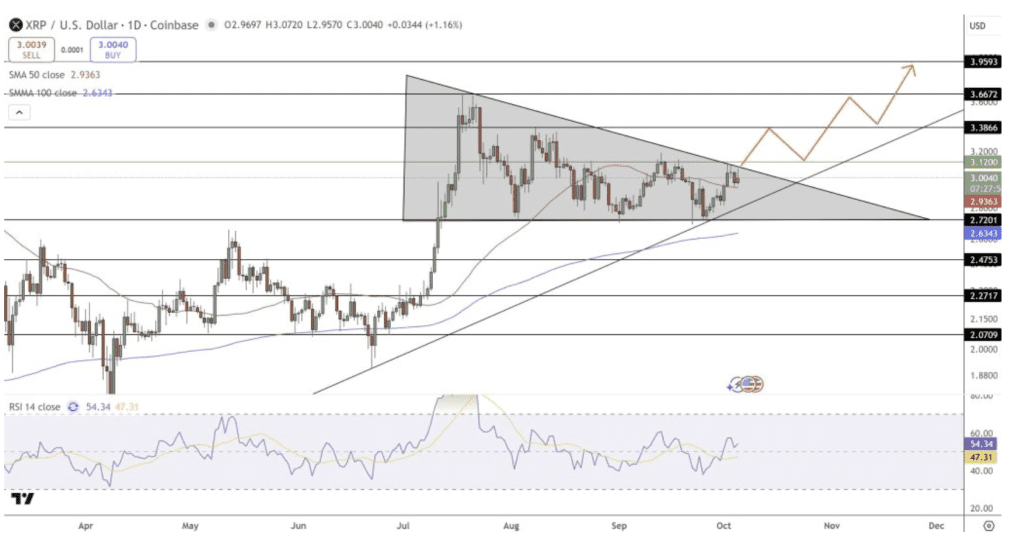

XRP’s market capitalization has reached $180 billion, making it the third-largest asset on the market. Despite the apparent calm, the chart indicates the formation of a symmetrical triangle—a pattern that often heralds a strong price move.

The highs are converging and the lows are rising, indicating a balance between buyers and sellers. However, a daily close above $3.00 could be the first signal of an upward momentum.

If the price consolidates above $3.12, analysts expect a move to $3.38 → $3.67 → $3.95.

Key support remains at $2.93 (50-day SMA) and $2.63 (100-day SMA).

This scenario could mark the beginning of a new multi-month rally, especially if institutional players continue to increase their positions.

Maxi Doge ($MAXI): A Meme Token with Real Functionality

The Maxi Doge ($MAXI) project is positioned as a token for daring investors, combining the thrill of trading, competition, and elements of gamification. Token holders receive:

- staking income with flexible returns,

- participation in trading challenges and contests,

- access to project events and integrations.

The smart contract has been audited by SolidProof and Coinsult, confirming the security of investments.

The presale has already raised over $2.7 million, and the token price is $0.0002605, but it will increase with each stage.

The XRP market is on the cusp of a potential breakout, while Maxi Doge is gaining traction among retail investors. Both assets deserve attention in October—one as a classic altcoin with a strong foundation, the other as a new, hyped player with elements of DeFi and GameFi.

Growth amid weak employment data

Global stock markets and Wall Street showed a confident recovery after their morning decline. Investors interpreted weak private sector employment data as a signal of possible further rate cuts by the Federal Reserve. Against this backdrop, the S&P 500 and MSCI All Country indices reached new record highs.