Stock trading ended mixed on Friday. Investors largely shrugged off the risks associated with the government shutdown.

The Dow Jones Industrial Average gained 239 points (+0.51%), after a daily gain of more than 500 points. The S&P 500 was virtually unchanged (+0.01%), while the tech-dominated Nasdaq Composite fell 0.28%.

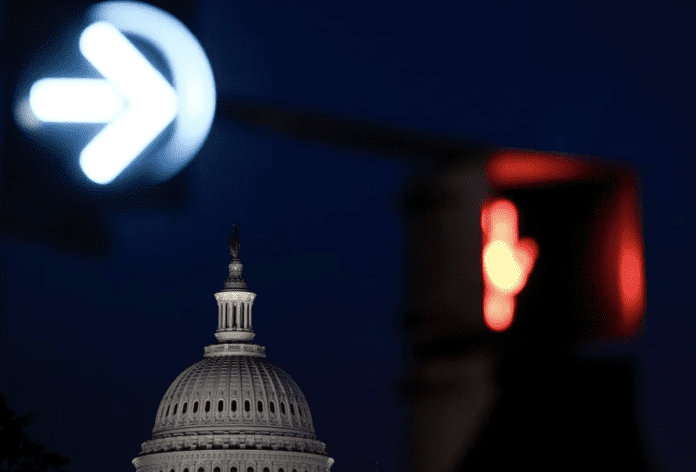

Stock markets remain at record highs despite the US government shutdown

In recent weeks, stock gains have been supported by strong corporate earnings, strong interest in artificial intelligence technologies, and expectations of a Federal Reserve interest rate cut.

History and Market Reaction

The Dow Jones and S&P 500 both hit new record highs. History shows that short-term government shutdowns typically have little impact on the stock market: they are short-lived and have minimal long-term economic impact.

“The shutdown is more of a high-profile political factor than a real blow to the economy,” notes Sam Stovall, chief investment strategist at CFRA Research.

Data Shortage

The main problem for Wall Street right now is not the shutdown itself, but the pause in the release of government macroeconomic data. Specifically, the key monthly employment report from the Bureau of Labor Statistics has not been released.

This complicates assessing the state of the labor market and inflation, especially at a time when stock prices are at historic highs and the market is vulnerable to surprises.

“A government shutdown at a time like this is especially painful. We are left without fresh labor market information, which coincides with signs of economic instability,” noted Mark Hamrick, senior economist at Bankrate.

The Bureau of Labor Statistics, the Bureau of Economic Analysis, and the Census Bureau have already confirmed they will suspend data releases until the shutdown ends.

Risks of a Protracted Crisis

Despite indexes rising more than 1% last week, analysts warn that the longer the shutdown lasts, the greater the risk of uncertainty for investors.

“We see the market is overly optimistic and underestimating the potential impact of a prolonged shutdown,” said Keith Buchanan, senior portfolio manager at Globalt Investments.

Alternative Sources

Investors and economists are forced to rely on private data. For example, a report from ADP showed a loss of 32,000 private sector jobs in September. These figures increased expectations for a Fed rate cut and supported stock gains, but also pointed to a deterioration in the labor market.

UBS Chief Economist Paul Donovan compared such data to “peering through a keyhole”: they provide a picture, but a very limited one.

The lack of official data complicates the Federal Reserve’s work. “The Fed is operating almost blind,” emphasized Nomura Chief Economist David Seif. If the shutdown lasts longer than usual, the Fed may simply not have high-quality data to analyze by its September and October meetings.