Stellar XLM fell by 3% under pressure from institutional selling: volatility remains elevated, key levels are $0.395 and $0.375

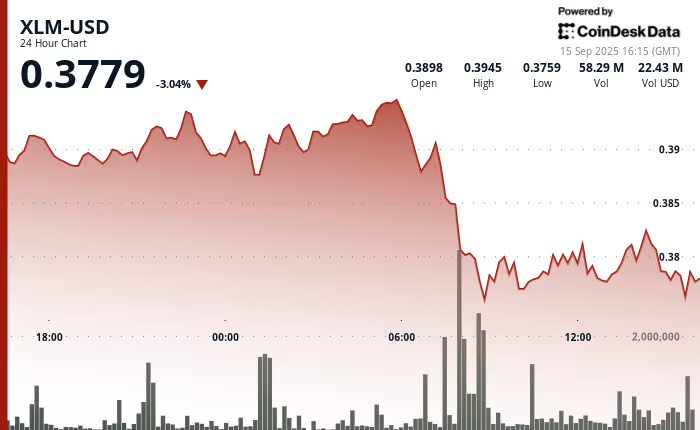

Over the past 24 hours, the Stellar XLM market has experienced a sharp surge in activity and ultimately closed down by about three percent: quotes fell from $0.39 to $0.38. The main driver of the movement was active profit-taking by large participants – institutional sell-offs dominated the order books and actually set the tone for the trading session.

Trading turnover confirms the nervousness of the market. The total volume for the period jumped to 101.32 million, which is almost three times higher than the average daily values of around 24.47 million. The peak of activity occurred on the morning of September 15: it was then that aggressive sales provoked chains of liquidations, increasing pressure on the price and accelerating the decline. Within two hours, the quote fell from $0.395 to $0.376. After this candle, the $0.395 level actually consolidated as a hard resistance: attempts to grow near this mark repeatedly choked, meeting dense offers.

At the same time, counter demand began to form below. In the $0.375 area, purchases appeared, which locally took the hit and designated a preliminary support. The nature of the session remained jagged: the general vector was downward, but intraday rollbacks signaled that some participants were using the dips to gain a position. In the period from about 13:15 to 14:14 on September 15, XLM managed to rise from $0.378 to an intra-session maximum of $0.383; the hour ended around $0.380. During this period, the turnover exceeded 10 million, and in some minutes large transactions with a total volume of up to 3.45 million took place – a typical picture of the struggle for the initiative after a sharp drain.

If we look at the entire range of fluctuations, the swing was about $0.019 between extremes, which is equivalent to about 5% volatility per day. As the sharp movement faded, the price began to consolidate in a narrow area of $0.380–$0.381. This shelf gradually turned into a “base”, from where the market will either try to squeeze the price higher to the resistance of $0.395, or, on the contrary, fall back to the demand zone of about $0.375.

Behavioural signs indicate the distribution of positions on the part of major players: sales “on strength” in the area of $0.395 regularly disrupt local up-trends, and catching knives near $0.375 looks more tactical – counting on quick rebounds and short fixes. For short-term traders, this is essentially a corridor in which the immediate direction is decided: consolidation above $0.395 will open up space for continued recovery, while a confident exit below $0.375 will increase the risk of updating local minimums.

To summarize, the session marked two key marks – resistance at $0.395 and support at $0.375, and also showed that while maintaining increased volumes, the market remains sensitive to the actions of institutional participants. As long as XLM is held between these levels, the sideways scenario remains basic; an impulsive violation of the range boundary will signal a change in the short-term balance of power.

Perplexity AI, considered one of the main competitors of ChatGPT, presented a study in which it compared the dynamics of the development of XRP, Solana, Stellar and the new token Snorter. Analysts came to the conclusion that investors can expect significant returns in the coming months. This forecast is associated with the growing interest of institutional players in stablecoins, cross-border transfers and tokenization of real assets.

The market confirms these expectations. Bitcoin recently updated its historical maximum, rising to $ 124,128. This jump is considered an indicator of a confident “bullish” mood, which can become a catalyst for larger-scale growth in the crypto market.